Computer fixed asset depreciation

We help companies recover value from their IT assets securely and responsibly. It is obtained by multiplying the straight-line depreciation rate by a coefficient.

The Basics Of Computer Software Depreciation Common Questions Answered

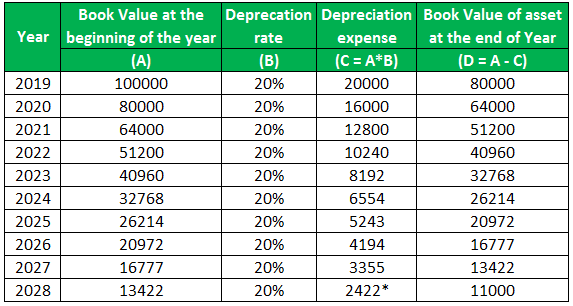

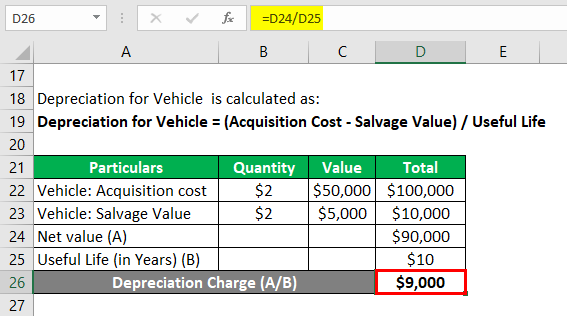

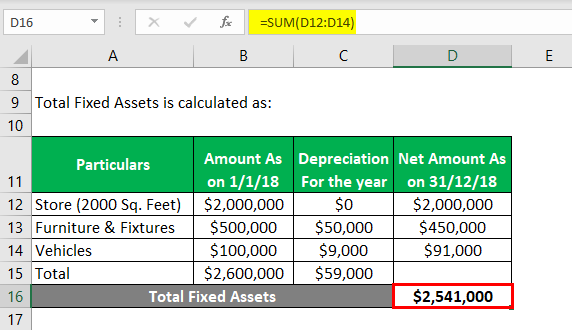

Straight-line depreciation This is the most basic version of depreciation in which you pay equal annual installments until the entire asset is depreciated to its salvage value.

. A fixed asset has an acquisition cost of. The value of the coefficient depends on the duration of use and the nature of the equipment. It is the increase in one currencys value against another.

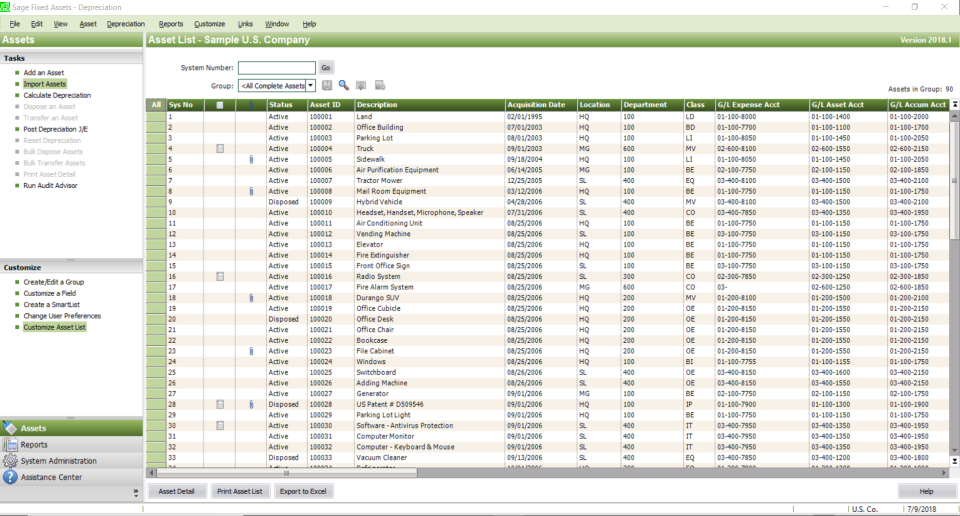

You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. That said companies like Apple have. From the Detail Type dropdown.

Depreciation Amount Fixed Depreciation Amount x Number of Depreciation Days 360. Exchange rates are relative and used as a comparison of the currencies of two countries. Hello there YAD.

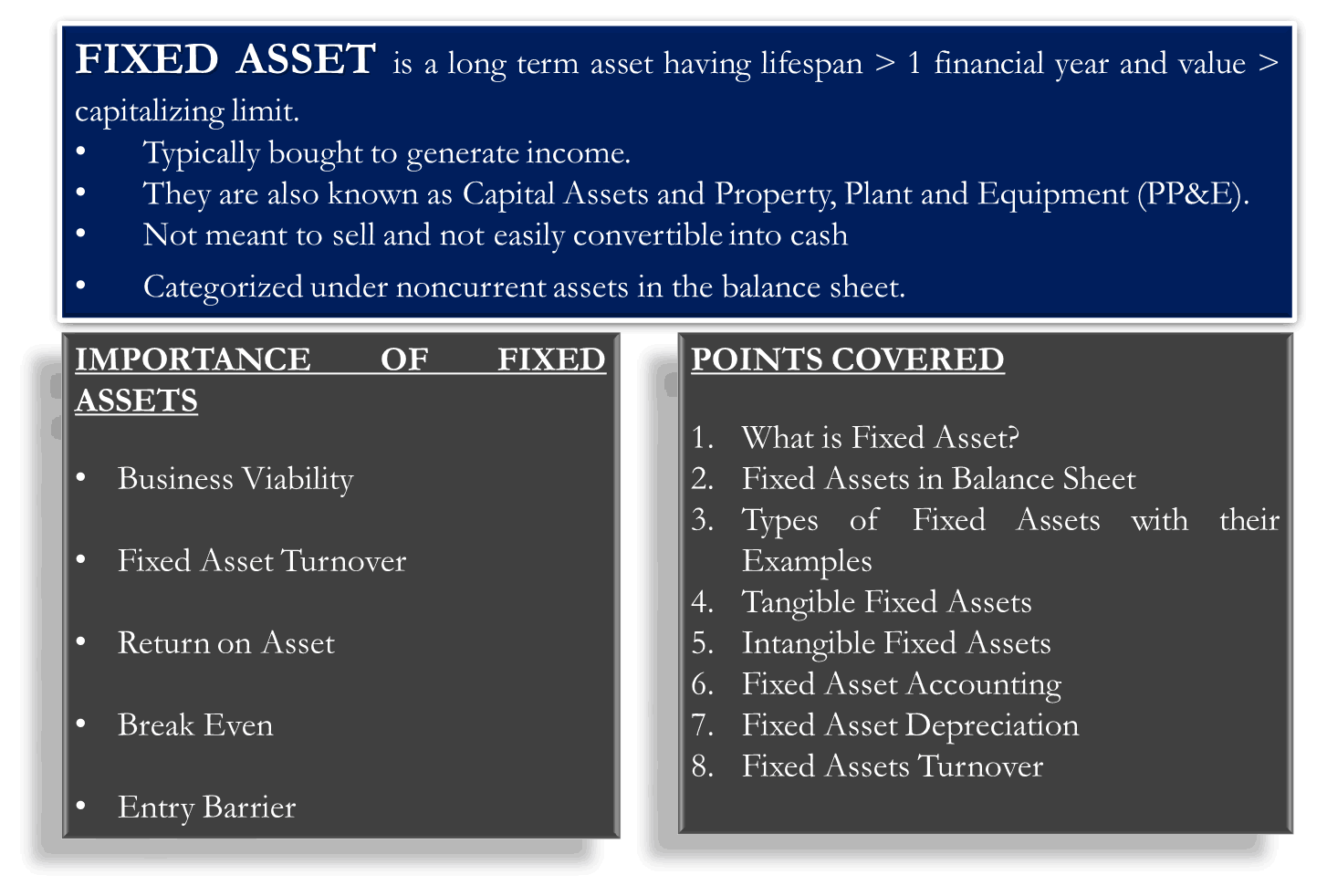

Example - Straight-Line Depreciation. The asset must be acquired purchased gift-in-kind for use in operations and not for investment or sale. Go to the Accounting menu.

The asset must have a useful life of at least three years. Ad CNE is a full-service IT asset disposition ITAD partner. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section.

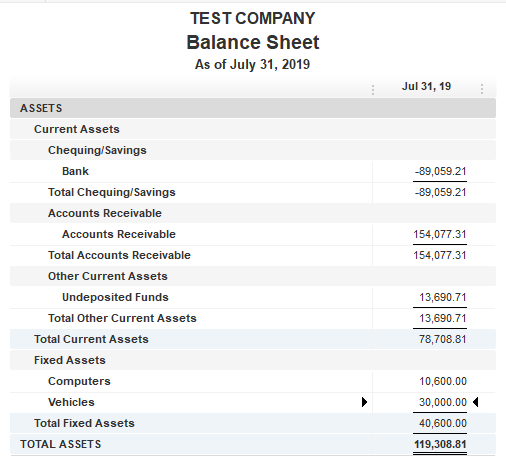

The policy defines the treatment of Non. However before we proceed. From the Account Type dropdown select Tangible Assets.

The purpose of this Fixed Asset Policy is to ensure that the Academys balance sheet correctly reflects the assets and liabilities of ParkSchool. Under Internal Revenue Code section 179 you can expense the. Since software is considered to be like a physical fixed asset with most companies it is depreciated instead of amortized.

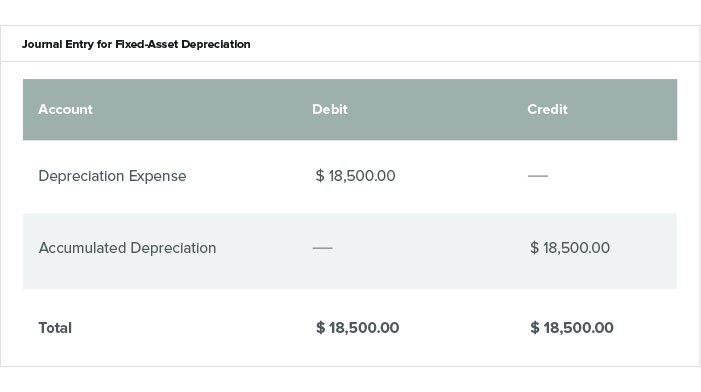

To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using. The Commissioner of Taxation issues the annual taxation ruling TR 20195 which contains the effective life of depreciating assets under s 40-100 of ITAA 1997. You can create a journal entry to record the depreciated amount by debiting all the depreciation expense then credit fixed asset.

Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account. Select Chart of Accounts.

20 Best Fixed Asset Management Software Of 2022 Financesonline Com

Fixed Asset Accounting Made Simple Netsuite

Depreciation Rate Formula Examples How To Calculate

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Fixed Asset Journal Entries Depreciation Entry Accumulated Depreciation Youtube

How To Prepare Depreciation Schedule In Excel Youtube

Fixed Asset Register Depreciating Your Assets What You Need To Know

What Is Fixed Asset Type Tangible Intangible Accounting Dep

Top 10 Fixed Asset Management Software Free Paid Softwareworld

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Fixed Asset Register Depreciating Your Assets What You Need To Know

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

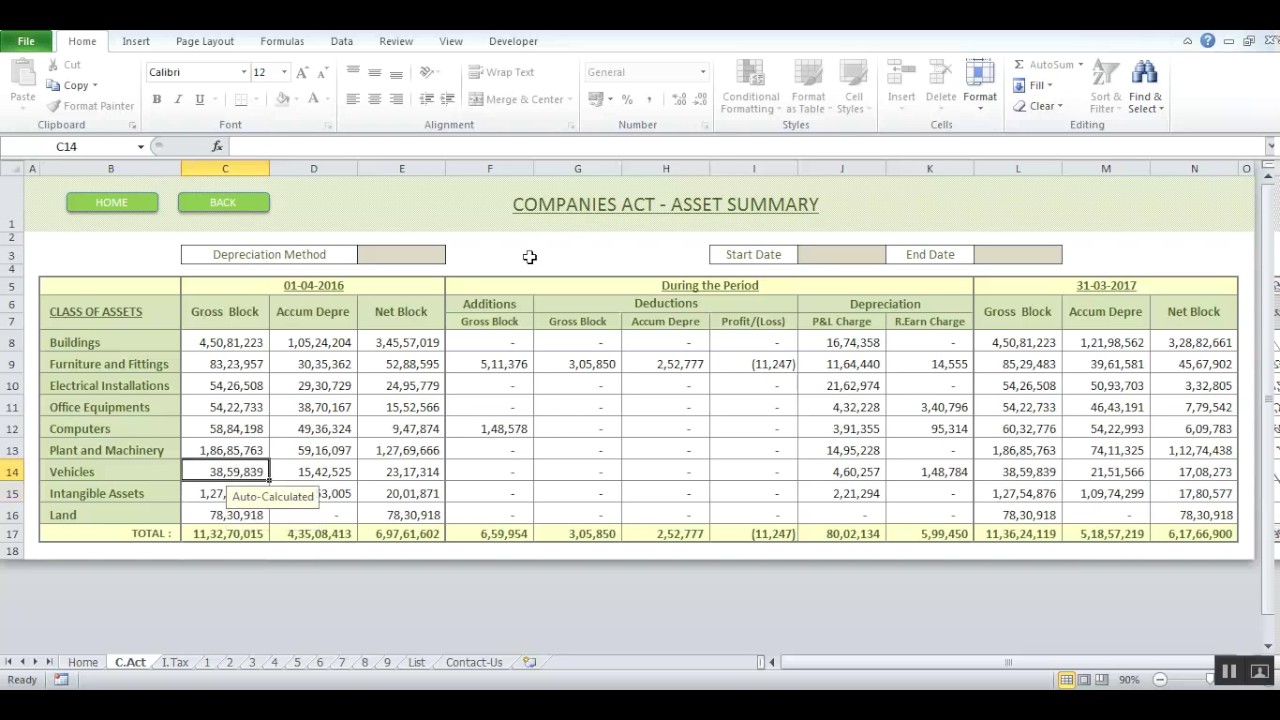

Depreciation Calculator For Companies Act 2013 Fixed Asset Register Youtube

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Computer Software Depreciation Calculation Depreciation Guru

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition